What next for the Euro if the US decides to inflate its way out of a debt crisis?

This time we take the EUR/USD FX rate as our focus.

The euro acted as a safe haven during April’s tariff wars and, if the US decides to inflate its way out of a debt crisis, it could go significantly higher.

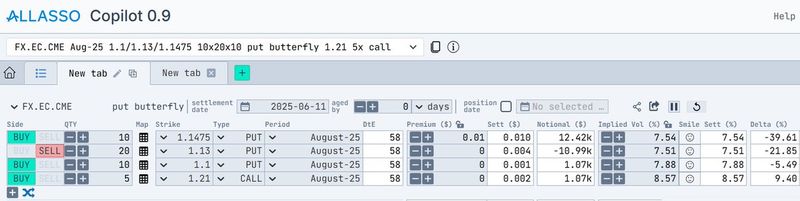

The following structure in Figure 1, which requires some explanation, acts as a low-cost way to play EUR upside, with bounded risk.

We've bought a broken put fly on the euro to “fund” the purchase of an out of the money call. If the spot EUR/USD rate stays relatively fixed, the forward will roll down into strike zone for the fly, offsetting the cost of the call.

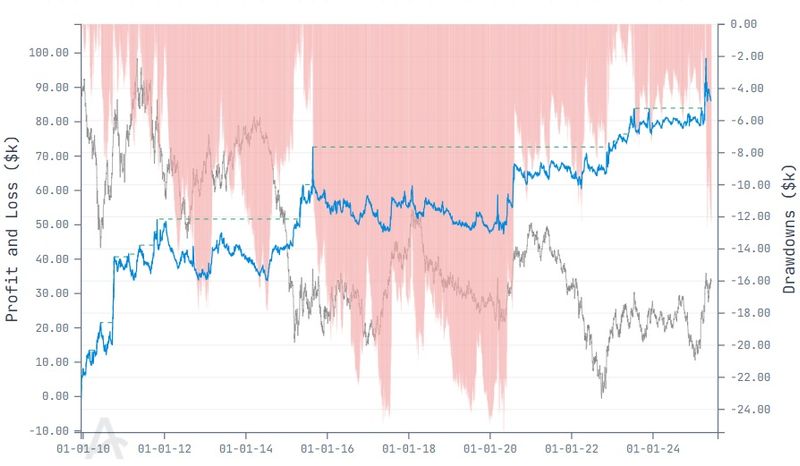

Conversely, if the euro spikes higher, we capture a decent poercentage of the upside. Figure 2 is illustrative, as we see long flat stretches (blue line), with the occasional jump higher. The graph was taken from the “Strategy” module in Copilot, “Backtest” tab.

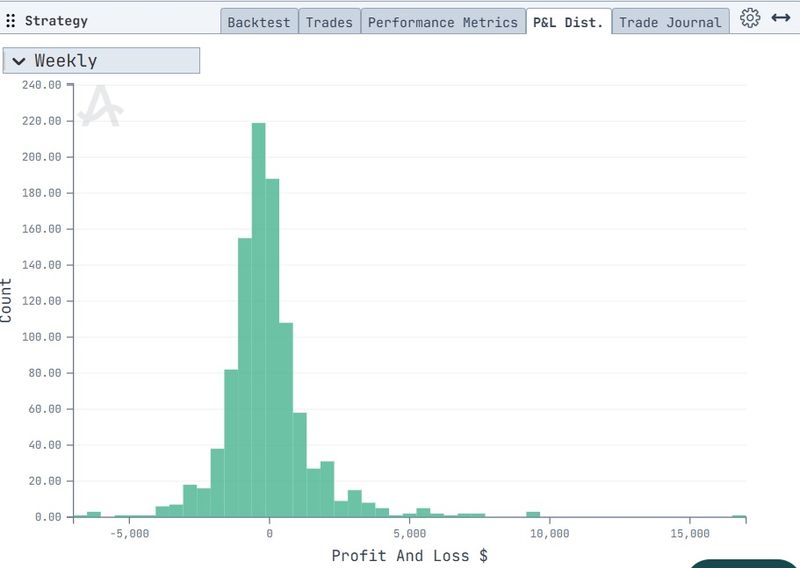

While median weekly returns are close to 0%, the histogram (Figure 3), taken from the “Strategy” module in Copilot, “P&L Dist” tab, is strongly positively skewed. This drives performance.

As always, this is not a trade recommendation, simply a case study.