Option Backtesting

Backtest options like never before

The most powerful and flexible option backtesting platform for traders and quants

Flexible backtesting for everyone

- Backtesting for every user type

- An intuitive, one-click experience for traders

- A hands-on Python SDK for quants

- Start simple with visual tools like Copilot and move into fully customisable workflows

- Every user gets the same accurate data and high-speed computation

- Get the level of control that suits you, whether you’re exploring or engineering

Fully licensed, cross-asset data

- Full data licence included — no exchange contracts or hidden fees

- Reliable and high-quality data across all asset classes

- Transparent pricing — one platform, one cost

- Combine options, equities, futures, and crypto in a single backtest

- 20+ years of historical data with Greeks, IV, dividends, and corporate actions

Fast, secure, and tailored to quants

- Modern, intuitive analytics for quants and traders of all levels

- Sign in and start backtesting — no additional licenses or complex installations

- Zero set-up and seamless scaling with our cloud-delivered platform

- Get peace of mind with enterprise-grade security and data protection

- Built and refined by Allasso’s team of ex-traders, data scientists, and technology experts

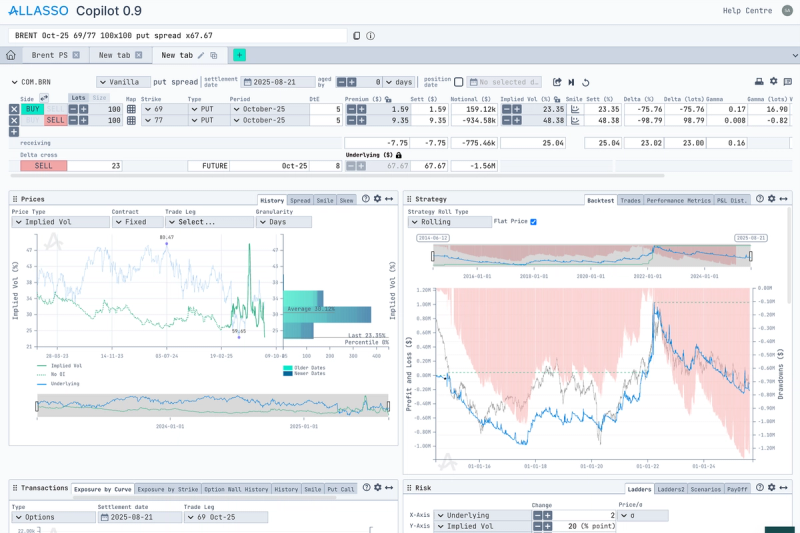

Option backtesting In Copilot

- Instant results: Quickly see how your strategy performs without setup or coding

- Visual insights: Interactive charts and summaries for P&L, returns, and drawdowns

- Preset strategies: Start testing immediately with built-in templates for popular option trades

- Easy customisation: Adjust strikes, expirations, or underlying assets in seconds

- Real market data: Get realistic outcomes by using historical data with accurate pricing and greeks

- Perfect for exploration: Ideal for traders who want a fast, intuitive entry point into options backtesting

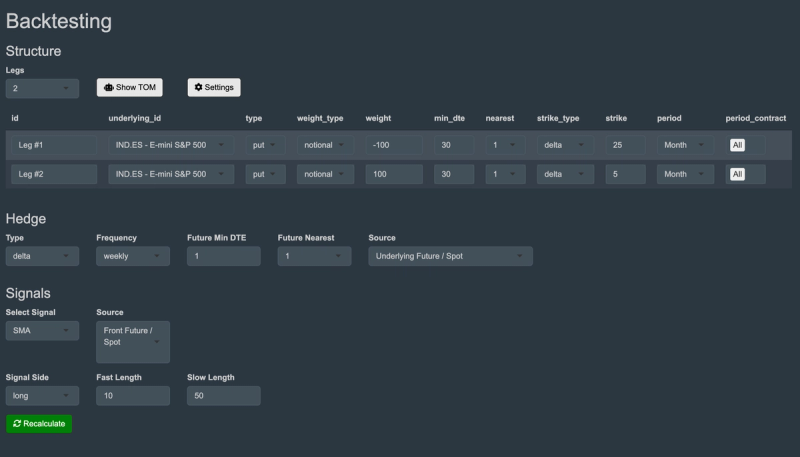

Custom option backtesting app

- Full-featured web interface: Never leave your browser with a complete platform for building and analysing option strategies

- No-code strategy builder: Model complex strategies easily by combining legs, expirations, and parameters visually

- Custom parameters: Fine-tune entry, exit, and position sizing for precision testing

- Instant visualisation: Review results in real time with rich analytics, equity curves, and performance stats

- Flexible scaling: Run small idea tests or full-scale multi-asset simulations — all from the same interface

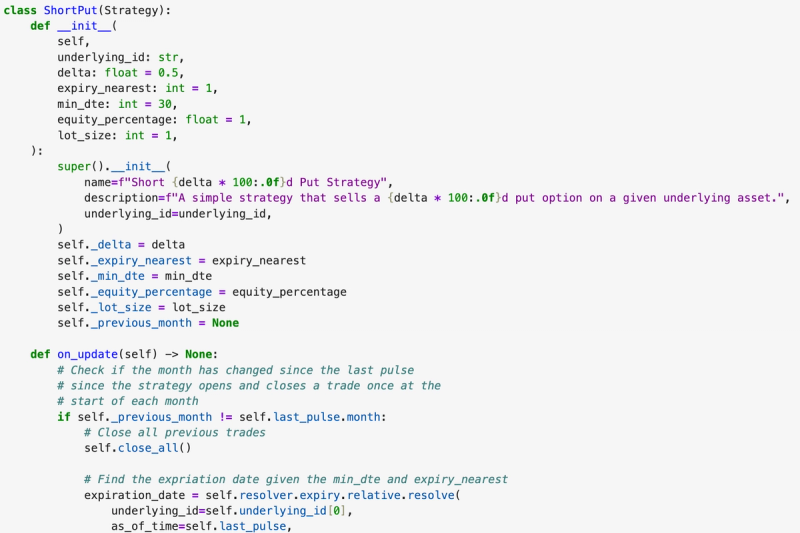

Allasso Pulse — Python SDK

- Unlimited flexibility: Build, customise, and automate any strategy directly in Python

- Full workflow integration: Seamlessly plug into your existing data pipelines, notebooks, or trading infrastructure

- Ideal for developers, quants, and data scientists: Designed for professional use cases and quantitative research

- Comprehensive access: Fine-grained control over instruments, strategies, and portfolio construction

- Scalable cloud execution: Run small tests or massive simulations with elastic cloud resources

- Open and extensible: Integrate external data, models, or ML frameworks effortlessly

Why Allasso?

Cost Efficiency

Save on data and infrastructure — everything you need is included, eliminating third-party costs and exchange fees.

Cross-Asset Data Intelligence

Powered by precalculated, high-quality data covering multiple asset classes — ensuring fast, consistent, and accurate results across instruments.

Time Savings

Run complete strategy backtests in seconds and move from idea to results instantly.

Instant Go-Live

Deploy and test strategies instantly — no additional setup required.

Zero IT Overhead

Cloud-native design eliminates installations, maintenance, or server management — it just works.

Limitless Capabilities

Scale from simple strategies to complex, cross-asset simulations with the same powerful engine.

FAQ

Have more questions? Here’s everything you need to know about how Allasso backtesting works.

What data do you use?

We use over 20 years of historical options and futures data, including Greeks, IV, mny, etc.

Do I need coding skills?

No, you can run full backtests using our intuitive web interface. For advanced users, the Python SDK offers unlimited flexibility

What does it cost?

Pricing depends on your plan and asset classes. All plans include full data access and backtesting tools — no extra licenses or hidden fees.

Can I test multiple assets in one strategy?

Yes, Allasso supports cross-asset and multi-leg backtesting directly in the web app or Python SDK.

How fast are the backtests?

Most strategies run in seconds thanks to our cloud-native computation engine.

Is my data secure?

Absolutely — all data is encrypted, and our platform uses enterprise-grade security protocols.

Can I export my results?

Yes, export full performance analytics, trade logs, and charts for deeper analysis.

Discover the next generation of backtesting built for traders, quants, and analysts. Whether you want an intuitive interface or full control through code, get unmatched speed, flexibility, and data depth — all in one place.

Key Highlights:

- 20+ years of historical, licensed options data ready to use

- No set-up, no coding, and no additional licenses required

- Lightning-fast cloud computation with instant results

- Support for multi-asset and cross-asset strategies

- Integrated tools for performance metrics, analytics, and portfolio overlays

- Scales effortlessly from idea testing to enterprise-level simulations