Options Trading in Oil and Gas

Analytics as good at their job as you are

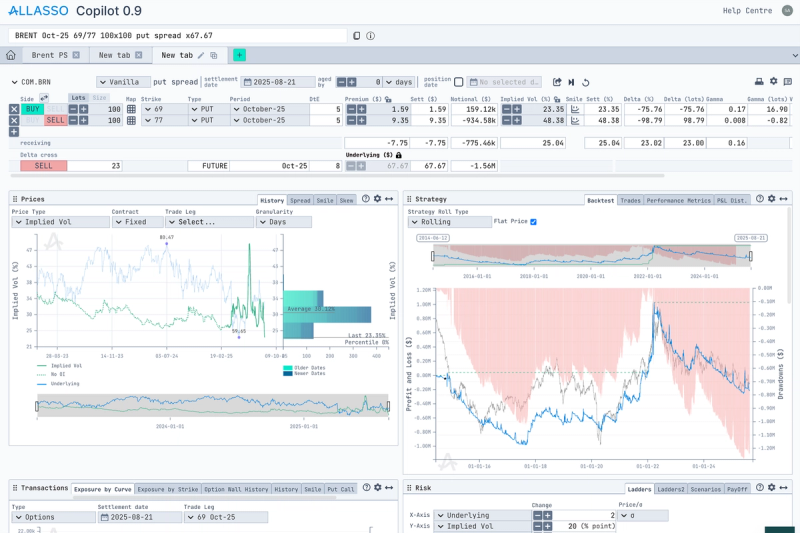

See every risk and opportunity with complete pre-trade analytics for oil and gas options — faster, easier, and all on one screen

Get the first 7 days FREE

Complete options analytics on one screen

- A one-screen solution means no more toggling spreadsheets and terminals

- Option pricer

- Historical IV metrics

- Instant backtesting

- Real-time risk analytics

- Open interest and volume analytics

Unlock 20 years best-in-class data

- Clean, corrected, and normalised datasets across leading energy products

- Long-term datasets for stress tests, backtests, and scenario analysis

- Implied volatility surfaces, seasonal strips, and skew dynamics

- Continuously rolled contracts for smooth, uninterrupted historical analysis

Fast, secure, and tailored to traders

- Designed and delivered by Allasso’s ex-trader, data scientist, and IT pro team

- Instant, intuitive, and optimised for trader workflows

- No additional licenses or complex installations

- Cloud-delivered tools mean instant set-up

- ISO-certified, with enterprise-grade data protection

- Unique features — backtesting, instant VaR, and portfolio overlays

Copilot takes your entire pre-trade workflow to a single screen — pricing, historical analytics, backtesting, risk, and positioning. No more juggling multiple tools, spreadsheets, and terminals.

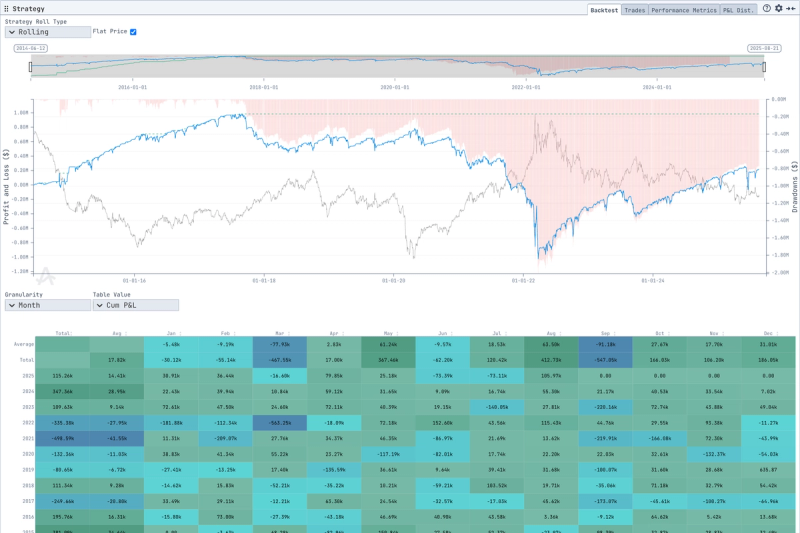

Test how your option strategies would have performed across decades of market history — instantly, and without spreadsheets. Identify strengths, weaknesses, and hidden risks before you commit capital.

- Run strategies on 20+ years of history

- Spot seasonality in performance

- Identify drawdowns and stress points

- Validate what actually works

- Get results in seconds

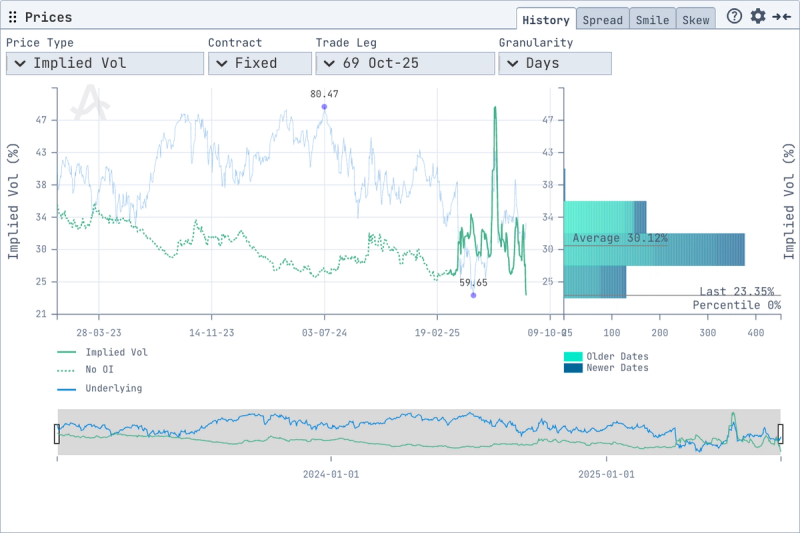

Understand today’s volatility in the context of decades of history. Track implied volatility trends across contracts, expiries, and strikes to spot extremes, mean-reversion opportunities, or regime changes.

- Access 20+ years of implied volatility history

- Identify volatility extremes

- Compare against the underlying

- Monitor shifts over time

- Use percentile rankings and averages to see whether today's volatility is exceptional or extreme

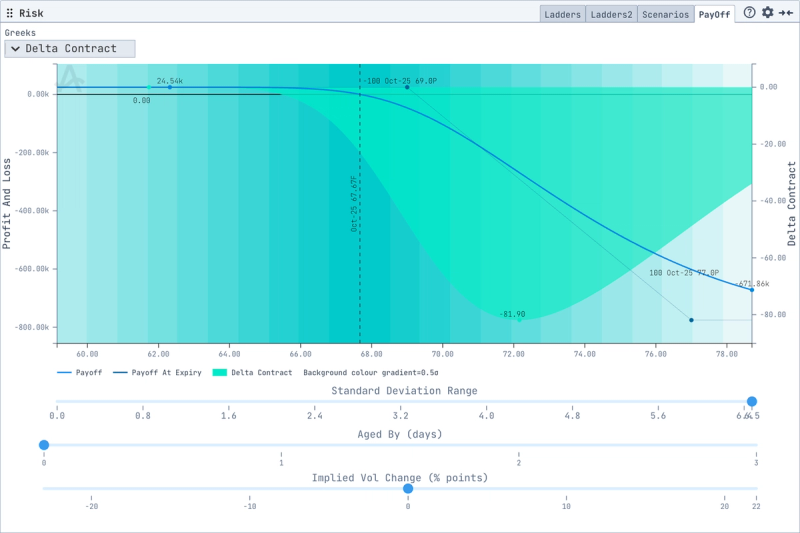

See exactly how your structure behaves under different market conditions — before you commit capital.

Copilot gives you instant visibility into risk through interactive tools:

- Payoff charts

- Scenario analysis

- Risk ladders

No more guesswork or static reports — understand your risk in real time, and trade with confidence.

See how the market is really positioned. Transaction and flow analytics give you instant clarity on volume, open interest, and call/put dynamics — so you can read sentiment and liquidity at a glance.

- Track open interest & volume

- Call/put ratios

- Strike-level exposure

- Historical context

No more guesswork — see who’s active, where they’re positioned, and how sentiment is evolving in real time.

Analytics that make life easier

Cost efficiency

Advanced options analytics at a fraction of the cost

Rich data

Built-in Greeks, volatility surfaces, and 20+ years of historical market data

Time savings

A single, seamless workflow — no need to juggle multiple tools

Instant go-live

Web-based platform, ready to use with zero IT setup

No IT overhead

Forget pipelines, VPNs, and maintenance headaches

Unique capabilities

Backtesting, instant VaR, and portfolio overlays you won't find elsewhere

Copilot Essential — Oil & Gas

ROAD-TEST Copilot’s Core Features

7-day free trial then $500 per user, per month

5 Core Oil & Gas Instruments

- Natural Gas (TTF, US Nat Gas)

- Crude oil (WTI, Brent)

- Emissions and carbon allowances (EUA)

Core Features

- Option Pricer: Price any strategy, from vanilla options to complex spreads

- Historical IV Metrics: Analyse volatility, skews, and regimes over time

- Backtesting: Test strategies against market history in seconds

- Real-time Risk Analytics: Monitor exposures and stress-test portfolios

- Open Interest & Volume Analytics: Track positioning, sentiment, and liquidity

- History: 5 years of market data